Abstract

In August 2018 the City of New York introduced new regulations on short-term rentals, requiring STR booking services to share information with the City. The regulations were due to come into effect on February 2, 2019, but have been blocked by a temporary judicial injunction. If the federal injunction were to remain in place, New York’s STR market would further commercialize over the next year. 10,800 housing units would be taken off the New York long-term housing market, leading to $60 million in rent increases over three years. Commercial operators would operate 18.5% of all entire-home listings. If the regulations take effect, they would produce a short-term drop in STR activity in New York (like when San Francisco enacted STR regulation), and give City officials greater ability to enforce STR laws. Under a strong enforcement scenario where the City targets commercial operators and hosts of full-time entire-home listings, 8,700 housing units which had previously been taken off the market by Airbnb would be returned to the market, reducing rents and increasing vacancy rates.

Executive summary

In August 2018 the City of New York introduced new regulations on short- term rentals, requiring STR booking services to share information with the City. The regulations were due to come into effect on February 2, 2019, but have been blocked by a temporary judicial injunction. Because of the resulting uncertainty, there is now a strong public interest in understanding the potential implications of the regulations. Relying on peer-reviewed methodologies, this report analyzes what will happen to Airbnb activity in New York City in the next year under several different regulatory scenarios.

Without new regulations

If the federal injunction were to remain in place, New York’s STR market would further commercialize over the next year:

- The number of housing units which would be taken off the New York long- term housing market by Airbnb, and thus would become unavailable for New York residents, would increase by 1,800 to 10,800.

- Average daily listings would increase 0.8% to 57,300, and 68% of listing revenue ($548 million of $806 million total revenue) would be earned from illegal reservations.

- Airbnb’s growth will lead to $8.6 million in rent increases for New Yorkers looking for apartments next year (and $60 million in rent increases over three years), in addition to the $616 million in previous rent increases identified by NYC Comptroller Stringer (2018).

- Commercial operators would operate 18.5% of all entire-home listings (up from 16.7%).

With new regulations

If the regulations take effect, they would produce a short-term drop in STR activity in New York (like when San Francisco enacted STR regulation), and give City officials greater ability to enforce STR laws. Under a strong enforcement scenario where the City targets commercial operators and hosts of full-time entire-home listings:

- Average daily listings decline of 46%: Average daily listings in New York City would decline from 56,800 to 31,000.

- 8,700 housing units back on the market: 8,700 housing units which had previously been taken off the market by Airbnb would be returned to the market, reducing rents and increasing vacancy rates.

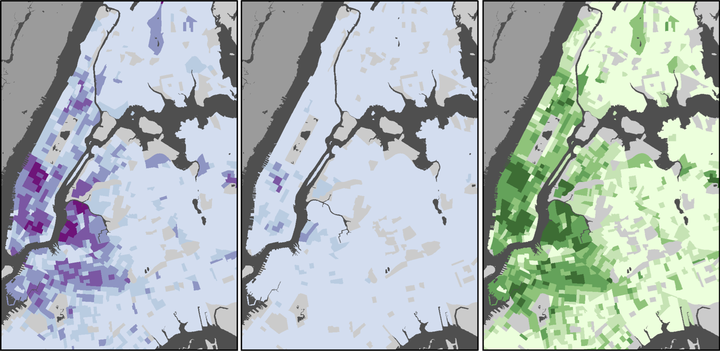

- Rental vacancy rate increase next year in top Airbnb neighborhoods: Many New York neighborhoods currently facing an affordable housing crisis (rental vacancy <5%) would see those vacancy rates significantly increase next year, and housing become correspondingly easier to find, as listings returned to the market:

- Williamsburg and Greenpoint: From 2% to 3.4%, with 720 housing units returned

- Chinatown and the Lower East Side: From 3% to 4.1%, with 730 units returned

- Park Slope and Red Hook: From 1.9% to 2.8%, with 290 units returned

- Bedford-Stuyvesant: From 4.8% to 5.8%, with 400 housing units returned

- Chelsea, Clinton and Midtown: From 6.4% to 8.2%, with 1,160 units returned

- $130 million reduction in rent payments over the next three years: A strong enforcement scenario would lower median new rents citywide, saving New Yorkers looking for new apartments approximately $19 million in rent payments next year, and $130 million over the next three years.

- Illegal revenue down 69%: Listing revenue on Airbnb in New York increased 21% to $711 million last year—an increase driven primarily by the further commercialization of the city’s STR market—but under a strong enforcement scenario illegal revenue would drop 69% to $170 million.

The report is available to download here .